Your Complete Guide to Local Property Tax (LPT) in Ireland

Navigating the world of local property tax (LPT) in Ireland can be a daunting task. This blog aims to demystify LPT, explaining what it is, why it’s important, along with a step-by-step guide on how to pay it online. We’ll also provide insights into some of the most frequently asked questions around LPT to help you make informed decisions.

CONTENTS

Step-by-Step Guide

Frequently Asked Questions

Do I Need To Pay LPT in 2024?

What Kind of Property is Considered Residential?

How Do I Know How Much to Pay?

Do I Include The Land My Property Is On?

Do I Have To Do This Every Year?

What If I Don’t Make A Return?

How Do I Pay?

What If I Can’t Pay?

I Own More Than One Property, What Do I Do?

Conclusion

What is LPT (Local Property Tax)?

The Local Property Tax (LPT) is an annual self-assessed tax based on residential property values in the Republic of Ireland. The owner of the property is liable, regardless of whether you reside at the property or not. The monies raised by the collection of LPT are used to finance local authority services, for example, libraries, public parks and street lighting.

When Was LPT Introduced in Ireland?

The Local Property Tax (LPT) was introduced in 2013, and it plays a crucial role in funding local government services, including infrastructure, amenities, and public services.

How Much is LPT in Ireland?

Your Local Property Tax (LPT) charge is calculated based on your property’s value as of November 2021. You can use Revenue’s online LPT calculator to calculate your LPT. If you think their calculation is wrong, use your best estimate. To help with this, you can check the Residential Property Price Register to search for similar houses in your area and the prices they sold for most recently.

LPT bands and rates

The Local Property Tax (LPT) is determined by the valuation band assigned to a property. The valuation date for LPT is 1 November 2021. Each valuation band corresponds to a specific basic LPT rate applicable for the valuation period from 2022 to 2025. Revenue has outlined the LPT rates for properties valued up to €1.75 million, categorised by their respective valuation bands.

For instance, if your property was valued at €360,000 in November 2021, it falls into band 4, resulting in an annual LPT payment of €405.

On the other hand, if your property is valued at a higher end, say €1.35 million, it falls into band 53, and your annual LPT payment will be €1,846.

Properties valued above €1.75 million are subject to a more complex calculation: 0.1029% of the first €1.05 million, 0.25% of the balance between €1.05 million and €1.75 million, and 0.3% of any amount exceeding €1.75 million.

Step-by-Step Guide to Paying Local Property Tax Online

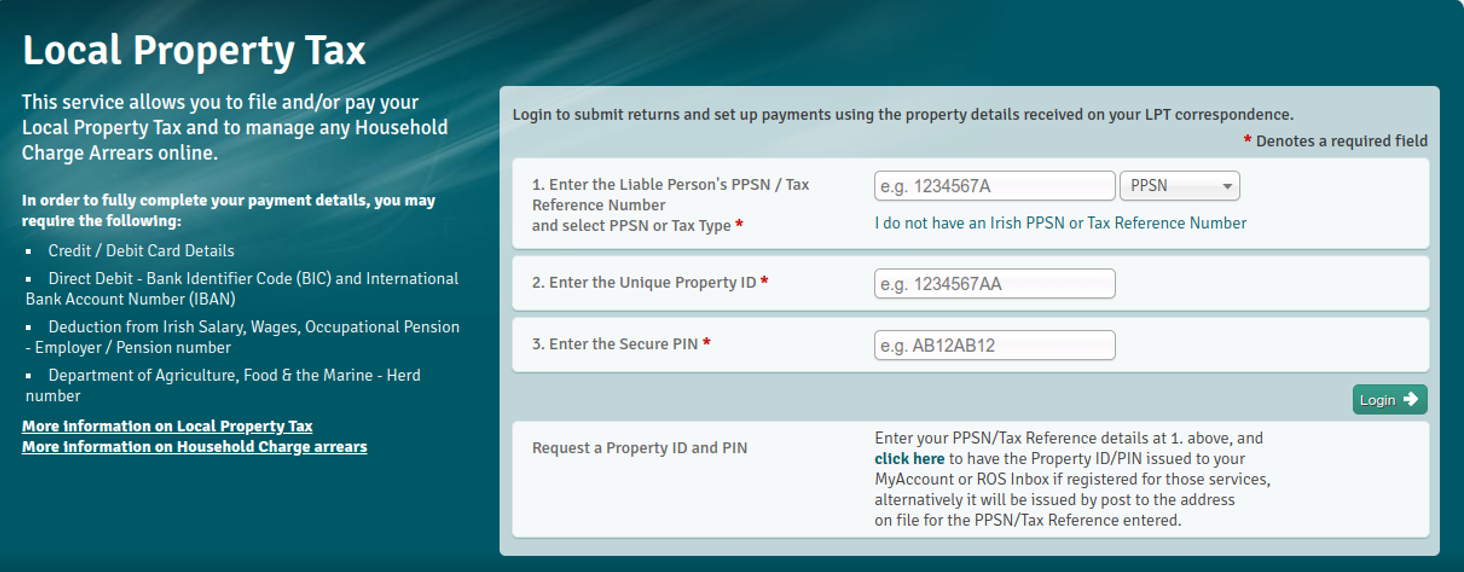

1. Go to Revenue’s LPT portal to submit your return. This will have been posted out to you or should be available on your MyAccount (My Docs section). First, you need to log in. You need your PPS number, your unique property ID and your secure PIN. If you don’t have them, call Revenue’s LPT helpline on 01 738 3626.

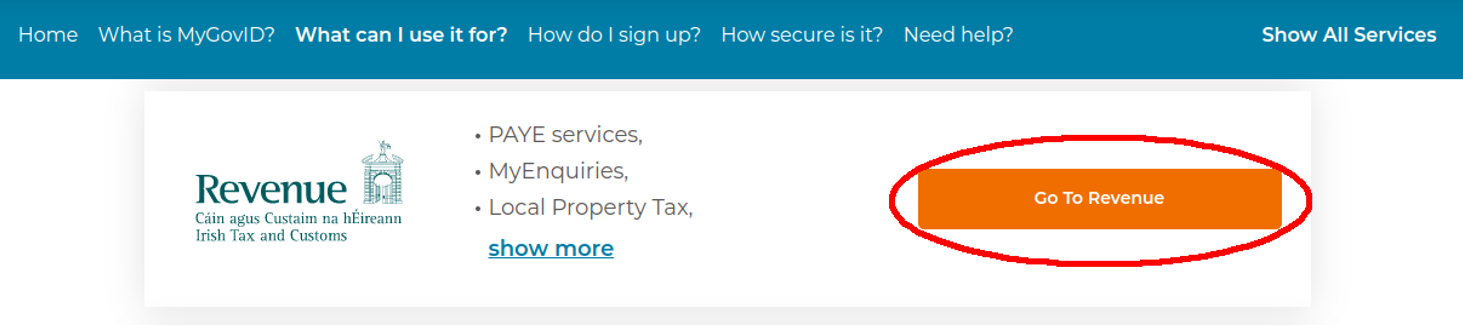

Alternatively, you can log in via your MyGov account or the Revenue Online Service (ROS).

2. If you are using your MyGov account, click on ‘Show All Services’ on the right then click on the orange ‘Go To Revenue’ button.

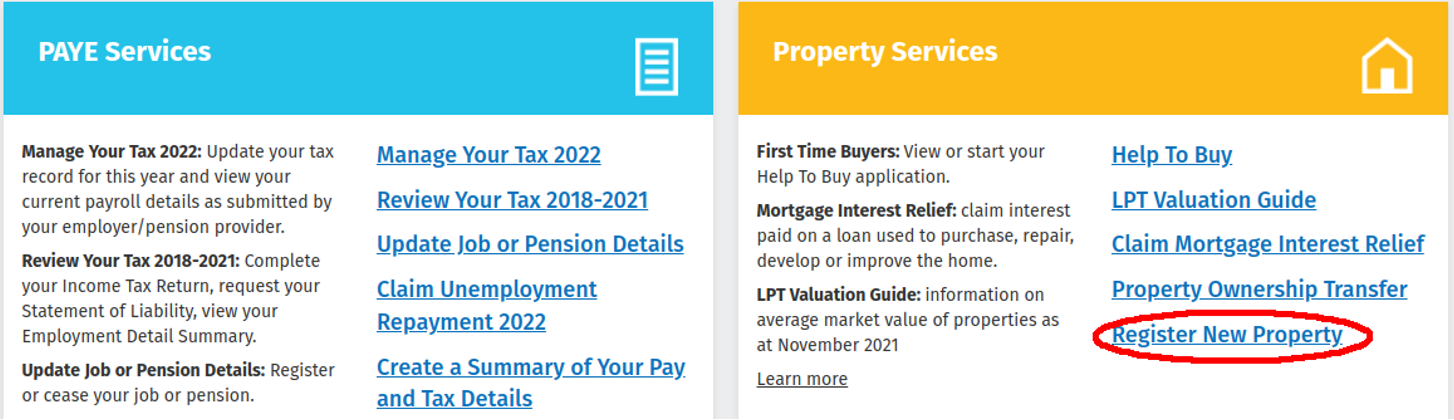

3. You will then see this screen. ROS users will see the same screen. Click on ‘Register New Property’ on the yellow panel to the right as seen below.

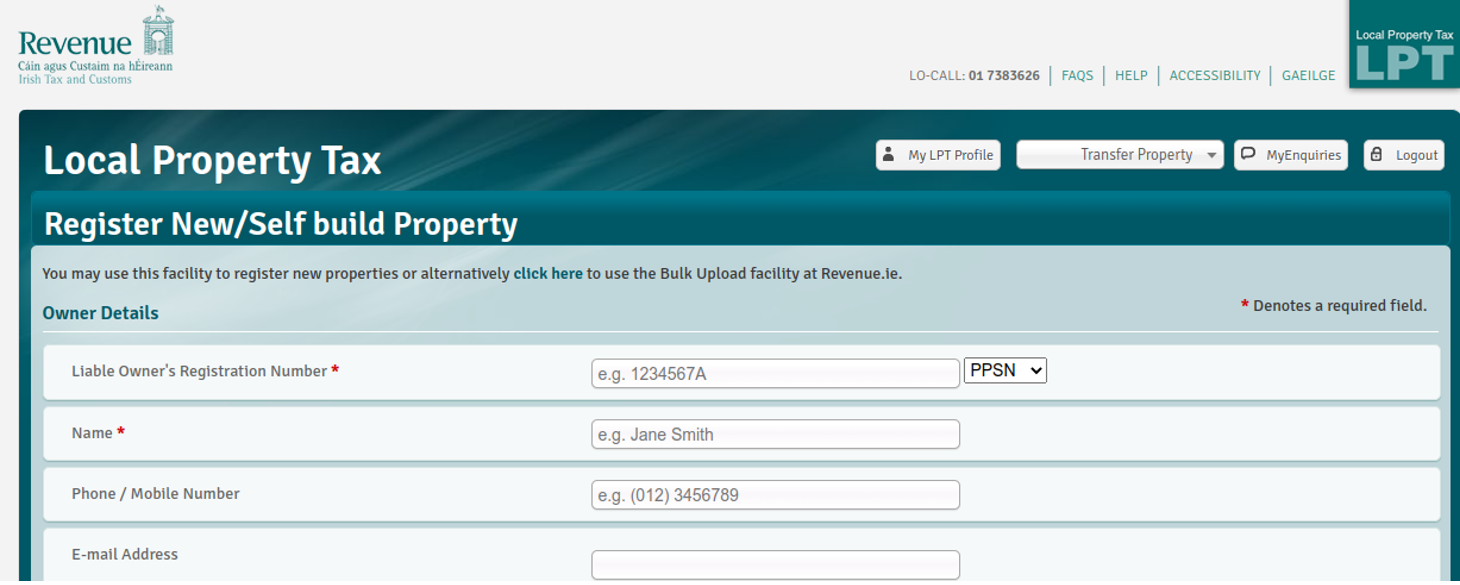

4. You will then be taken to this screen. Input all the details requested.

Then click continue at the bottom to arrange your payment.

Frequently Asked Questions on LTP

Do I need to pay LPT in 2024?

If you were a residential property owner on 1st November 2022, you are liable to pay LPT in 2023. Similarly, You are liable for LPT in 2024 if you own a residential property on 1 November 2023.

You should confirm your payment method with Revenue by:

- 1 December 2023, if you choose to spread the payments over the year

- 10 January 2024, if you choose to pay in a single payment

What kind of property is considered residential?

Any property which is suitable for residential purposes.

If your property is a self-contained unit within a larger residential building, for example, an apartment within a block, you must pay LPT for your unit.

How do I know how much to pay?

Your liability is calculated based on your property’s value as of November 2021. You can accept the valuation on Revenue’s LPT system. If you think their calculation is wrong, use your best estimate. To help with this, visit www.propertypriceregister.ie and search for similar houses in your area and the prices they sold for most recently.

Do I include the land my property is on?

Do I have to pay LPT every year?

You have to pay local property tax online for every year you continue to own your property. However, you do not have to re-submit the information above annually as it remains valid for four years (2022-2025).

What if I don’t make a return?

Revenue will pursue you for the amount owed, according to their valuation, and will continue to contact you until you make a return.

How do I pay LPT?

Pay the amount in full in one payment:

• With a debit or credit card.

• By annual payment instruction.

• Via a one-off payment through a payment service provider.

Pay across the year:

• By monthly direct debit.

• Via weekly or monthly payments through a payment service provider.

• By deduction at source, for example, from your wages or social welfare payment.

What if I can’t pay LPT?

Individuals with an annual income below €18,000 or couples with a combined annual income below €30,000 can postpone their local property tax payment in full. However, it’s important to note that interest will accrue on the outstanding amount, and payment will eventually be required. In cases of genuine financial hardship, deferrals of payment can be requested.

I own more than one property, what do I do?

Owners of two to ten properties submit individual returns for each property. Owners of eleven or more properties can create a list containing details of each property and its value and upload that when making their submission.

Need Help Filing Your Local Property Tax Return?

By using the instructions and information above, you are ensuring your tax situation remains healthy and preventing yourself from receiving nasty surprises in the future. In situations where you decide to sell your property, clearance of any outstanding LPT obligations will be enforced prior to sale completion. It is much better to get your LPT duties in order in as timely a manner as possible.

Self-assessed Taxpayers

A 10% surcharge is added to your liability – which can be more than what is generally owed for LPT.

PAYE Workers

Revenue offset any future rebates on taxes against LPT owed.

If you have any questions about the local property tax? Feel free to get in touch and our team here at Tax Returns Plus will do their best to help you.

You can also contact Revenue’s LPT helpline at 01 738 3626 between 09.30 to 16.30 (Monday to Friday)

If you found this guide helpful, make sure you check out some of our other helpful guides.