Tax Residency Statuses in Ireland Explained

Navigating tax laws in Ireland can seem overwhelming, particularly when it comes to grasping the effects of different residency statuses. Ireland’s tax system outlines three main types of tax statuses: Resident, Ordinary Resident, and Domiciled. We’ll explore each status and its substantial impact on an individual’s taxation in Ireland.

Resident in Ireland

Determining residency in Ireland for tax purposes is predominantly based on the amount of time an individual spends in the country during a tax year. You’re considered a resident in Ireland for tax purposes if you:

- Spend 183 days or more in Ireland in a tax year. The tax year in the Republic of Ireland runs from January 1st to December 31st each year.

- Or spend a combined total of 280 days or more in Ireland over the current and preceding tax year, with a minimum of 30 days each year.

Residency under these conditions means you are liable to pay tax in Ireland on your worldwide income, not just the income you earn within the country.

Choosing to be a Resident in Ireland

It is possible to choose to be a tax resident in the tax year you arrive in Ireland despite not being present for the required number of days. This is if you:

- Arrive in Ireland with the intention of being resident in the following tax year

- And barring unforeseen circumstances, you will be a resident of Ireland in the following tax year.

If you choose to be a tax resident in Ireland, you can avail of Split Year Relief, also known as Year of Arrival Relief. This effectively means you become a tax resident from the moment you arrive in Ireland and only your Irish income is taxable in Ireland. You can also claim full tax credits. This only applies to revenue generated from your employment; it does not apply to non-employment income. If you choose to be a tax resident in Ireland in a tax year, you must write to Revenue.

Split Year Relief can also apply when you leave Ireland (year of departure relief). You must be resident in Ireland during the year of your departure and intend on not being resident again in the year following your departure. You must be leaving Ireland for more than a temporary purpose.

What is an Ordinary Resident?

Once you’ve been a tax resident in Ireland for three consecutive tax years, you attain the status of an ‘ordinary resident’. Unlike tax residence, ordinary residence focuses on the long-term presence and intention to remain in Ireland for the foreseeable future rather than just meeting the criteria for tax residence in a given tax year.

What Does Domiciled in Ireland Mean?

Domicile is a more permanent concept compared to residency. Domicile in Ireland is a legal concept referring to a person’s permanent home or country of origin or lives in with the intention of remaining there indefinitely. Every individual is born with a domicile, typically inherited from their parents. However, domicile can be changed under specific circumstances, such as establishing a permanent home in another country with the intention to remain there indefinitely. Your domicile status is significant because it influences the extent of an individual’s tax obligations, including applying various tax reliefs and exemptions.

What is Non-Domiciled Status?

Non-domiciled status refers to an individual’s tax position in a country where they reside but do not have their permanent home or domicile. Essentially, while a person may live in a country for a certain period and be considered a resident for tax purposes, they do not consider it their permanent home. This distinction is crucial for tax purposes, as non-domiciled individuals are typically taxed only on the income they earn within that country or income from abroad that is brought into the country rather than their worldwide income.

Irish Residency and Tax Credits

Citizens of the European Union (EU) or Nationals

- If at least 75% of your worldwide income is taxable in Ireland, you will receive full tax credits cumulatively.

- If less than 75% of your worldwide income is taxable in Ireland, you may receive a portion of tax credits.

Citizen of a Country with a Tax Treaty with Ireland

- You can receive full tax credits cumulatively if your only income source is Irish.

- If you also have a non-Irish source of income, you may receive a portion of tax credits.

Other Non-Residents

- All other non-residents will receive no Irish tax credits.

Categories of Taxpayers

| Taxpayer Category | Explanation |

| Resident Taxpayer (R) | Spent 183 or more days in Ireland, or more than 279 days over two years. At least 30 days in each year. |

| Non-Resident (NR) | Does not meet either of the criteria mentioned above. |

| Ordinarily Resident (OR) | Tax Resident for the previous 3 tax years. |

| Non-Ordinarily Resident (NOR) | Has not been a tax resident for the previous 3 tax years. |

| Irish Domiciled Taxpayer (D) | Ireland is considered to be a permanent home. |

| Non-Domiciled Tax Payer (ND) | Ireland is not considered to be a permanent home. |

Understanding Tax Implications Based On Your Residency Status

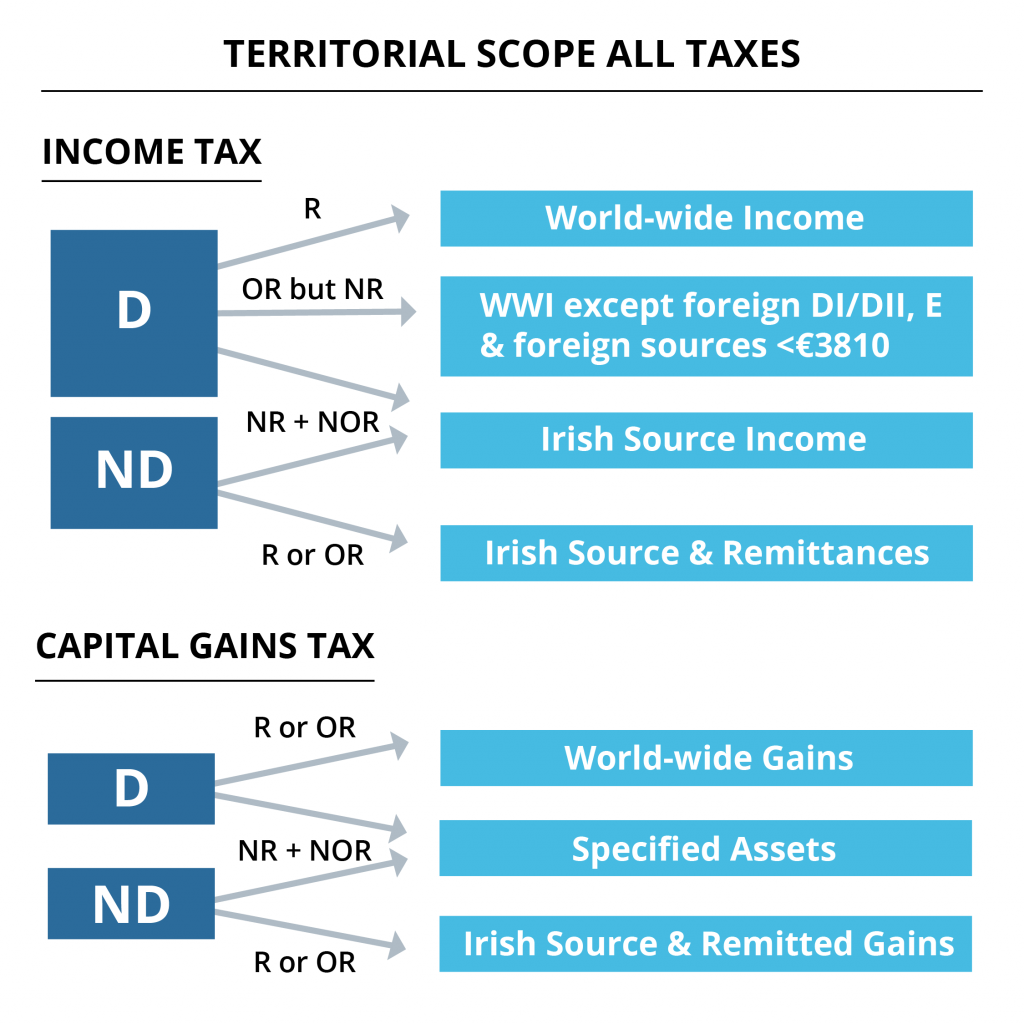

Income Tax

If you are Irish Domiciled and Irish Resident, then you are taxable in Ireland on your total worldwide income. This means any income earned in both Ireland and any other country must be declared in Ireland. This is the most common situation for most Irish taxpayers.

If you are Irish Domiciled but Ordinarily or Non-Resident, then you are taxable in Ireland on all worldwide income except for foreign employment and trade income. Also, in a further allowance by Irish tax authorities, you are not liable for tax on any other non-Irish income, if it is less than €3,810 in a particular year. Naturally, any Irish source income is taxable in Ireland.

Regarding Non-Domiciled, the only income tax due in Ireland, if you are Non-Resident or Non-Ordinarily Resident, is on Irish source income. If you are Resident or Ordinarily Resident, both Irish source income and any remittances (funds sent to an Irish bank account etc.) fall within the Irish tax net.

Capital Gains Tax (CGT)

Once again, for those who are Irish-domiciled and Resident or Ordinarily Resident, all worldwide gains are liable to Capital Gains Tax (CGT) in Ireland. CGT is generally charged at a rate of 33% in Ireland.

If you are Irish Domiciled and Non-Resident or Non-Ordinarily Resident, then only Specified Assets are liable to CGT in Ireland. Examples of Specified Assets would be land, buildings, and shares in Irish companies.

Similarly, if you are Non-Domiciled and Non-Resident or Non-Ordinarily Resident, you are only liable for CGT tax in Ireland on Specified Assets.

Finally, in terms of CGT, if a person is Non-Domiciled but Resident or Ordinarily Resident, then CGT applies to both Irish source gains and also remitted gains from abroad. Meaning, if a taxpayer sends gains from abroad to an Irish bank, this gain is liable to Irish CGT.

Income Tax vs CGT

As you can see from the above graphic, this area of tax can be very complex and leave many people very confused. At Tax Return Plus, our team of tax experts is here to assist you with any queries you may have regarding tax advice.

Conclusion

Understanding the 2024 Budget Highlights and knowing which tax credits you can claim can significantly impact your financial planning and tax liability.

Navigating your tax returns doesn’t have to be complicated! Resources like our guides on How to File Your Tax Returns and Relevant Tax on Share Options (RTSO) are designed to support you through every step of the process.

For personalised advice and assistance with your tax returns, complete our short form now to receive a quote and find out how our team can help you with your Inheritance tax return this year.

If you found this guide helpful, check out some of our other helpful guides.

This article is provided on the strict understanding that it is for the reader’s general consideration only. Accordingly, no action must be taken or refrained from based on its contents alone.